Automating Stock Trading with FinRL: Maximizing Profits in 2024

Automating Stock Trading with FinRL

Introduction:

In today’s fast-paced financial markets, the ability to make informed decisions swiftly is paramount for success. With advancements in technology, automated stock trading has emerged as a powerful tool for investors looking to capitalize on market opportunities efficiently. One such cutting-edge solution is FinRL, a framework designed specifically for automated stock trading using reinforcement learning techniques. In this blog, we delve into the world of automated stock trading with FinRL, exploring its capabilities, benefits, and potential for generating profitable investments. read more from finrl official site.

Understanding FinRL

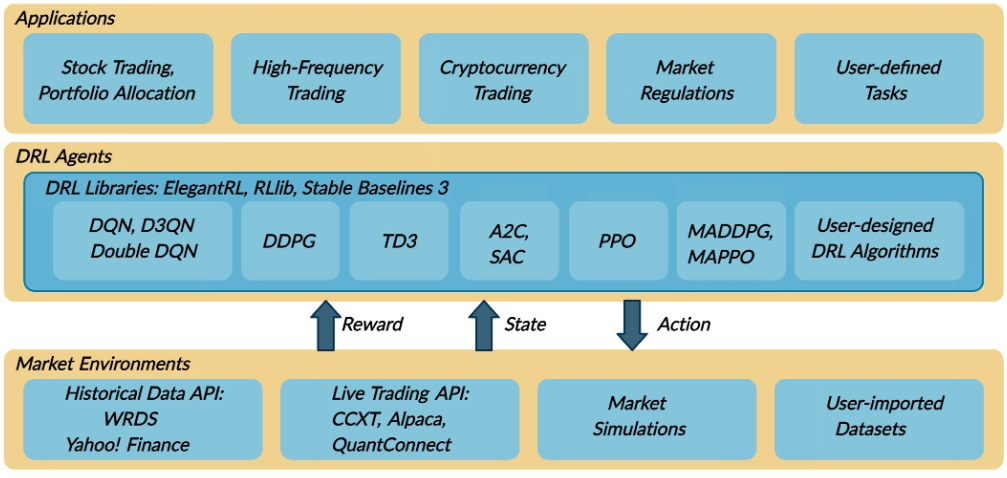

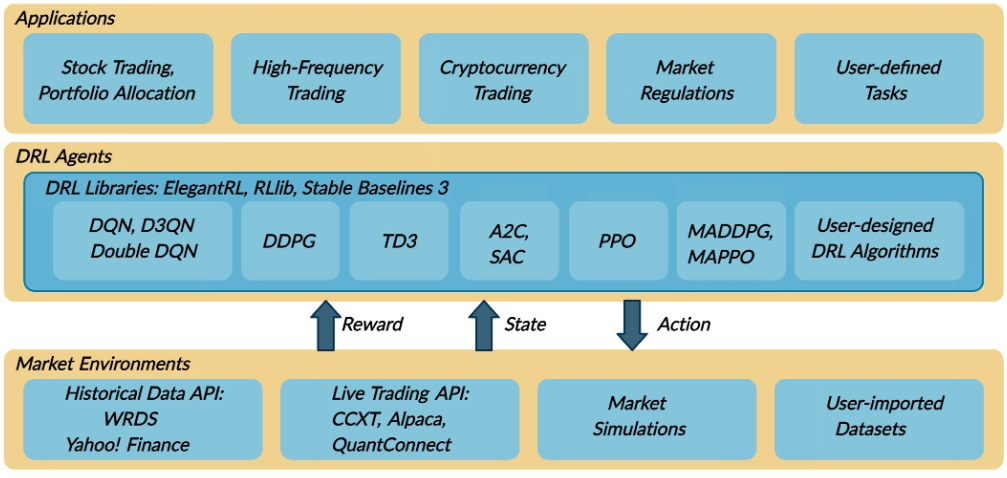

FinRL stands for Financial Reinforcement Learning. It is a Python library built on top of OpenAI’s Gym and Stable Baselines, tailored for solving financial trading problems using reinforcement learning algorithms. Reinforcement learning (RL) is a branch of machine learning where an agent learns to make sequential decisions by interacting with an environment to maximize cumulative rewards. In the context of automated stock trading, the agent seeks to optimize trading strategies based on historical market data and real-time information.

The Components of FinRL

1. Gym Environment:

- FinRL provides a gym-like environment where users can define the state space, action space, and reward mechanism for training their trading agent.

- The environment simulates the market dynamics and allows the agent to interact with it to learn optimal trading strategies.

2. Reinforcement Learning Algorithms:

- FinRL supports various RL algorithms such as Deep Q-Networks (DQN), Proximal Policy Optimization (PPO), and Deep Deterministic Policy Gradient (DDPG).

- These algorithms enable the agent to learn from past experiences and improve its decision-making abilities over time.

3. Trading Strategies:

- Users can implement and customize different trading strategies within the FinRL framework.

- Strategies may include momentum trading, mean reversion, trend-following, and more, depending on the investor’s preferences and market conditions.

4. Evaluation Metrics:

- FinRL provides tools to evaluate the performance of trading strategies using metrics like Sharpe ratio, maximum drawdown, and cumulative returns.

- These metrics help investors assess the risk and profitability of their automated trading systems.

Benefits of Automated Stock Trading with FinRL:

Speed and Efficiency:

- Automated trading systems powered by FinRL can execute trades swiftly, leveraging computational power to analyze vast amounts of data in real-time.

- This speed and efficiency give investors a competitive edge in capitalizing on market opportunities before manual traders can react.

2. Emotion-Free Trading:

- Unlike human traders, automated systems powered by FinRL are not influenced by emotions such as fear or greed.

- By removing emotional biases from the decision-making process, automated trading can lead to more rational and disciplined investment strategies.

3. Adaptability:

- FinRL’s reinforcement learning algorithms enable trading agents to adapt to changing market conditions and learn from new information.

- This adaptability allows automated systems to continuously refine their strategies and optimize performance over time.

4. Risk Management:

- FinRL facilitates the implementation of risk management techniques within automated trading systems.

- Users can set constraints on position sizing, portfolio allocation, and stop-loss mechanisms to mitigate downside risk.

Steps to Implement Automated Stock Trading with FinRL:

1. Data Collection:

- Gather historical market data for the assets you want to trade, including price, volume, and other relevant indicators.

2. Environment Setup:

- Define the trading environment using FinRL, specifying the state space, action space, and reward function.

3. Model Training:

- Select an appropriate reinforcement learning algorithm and train the trading agent using historical data.

- Fine-tune the model parameters to optimize performance and adjust to specific trading objectives.

4. Strategy Evaluation:

- Evaluate the performance of the trained model using backtesting and simulation techniques.

- Analyze key metrics to assess profitability, risk, and consistency of the trading strategy.

5. Live Trading:

- Deploy the trained model to execute real-time trades in live market conditions.

- Monitor the performance of the automated trading system and make adjustments as necessary.

Conclusion:

Automated stock trading with FinRL offers investors a powerful tool for navigating the complexities of financial markets. By harnessing the principles of reinforcement learning, FinRL empowers traders to develop sophisticated strategies that adapt to changing market dynamics, mitigate risk, and maximize returns. As technology continues to evolve, automated trading systems are poised to play an increasingly integral role in the investment landscape, offering both institutional and retail investors a competitive advantage in pursuit of financial success. Whether you’re a seasoned trader or a newcomer to the world of finance, exploring the possibilities of automated stock trading with FinRL can unlock new opportunities for profitable investments.

- How to Download Stock Data Using Interactive Brokers – 2024 - July 8, 2024

- Exploring the Best Python Libraries for Machine Learning – 2024 - April 20, 2024

- What is ElegantRL - April 11, 2024

1 comment so far