Mastering Quantitative Finance with FinRL: A Comprehensive Tutorial for Success

FinRL an open source framework that helps practitioners develop trading strategies using deep reinforcement (DRL).

The code for FinRL are available on AI4Finance Foundation‘s official GitHub Library.

What is FinRL’s goal?

Designing a Deep Reinforcement Learning Trading Strategy includes preprocessing of market data, creating a training environment and managing trading states. It also includes backtesting the trading performance. The end-to-end process is very comprehensive, but it’s also a tedious and error-prone debugging process.

FinRL’s Goal:

- FinRL offers a complete pipeline of services to help traders overcome the steep learning curve.

- FinRL is a finely tuned DRL algorithm that implements state-of-the art reward functions , and reduces the debugging work .

- FinRL is a framework that automates the development and testing of trading strategies. This allows researchers to iterate strategies with a high rate of turnover .

FinRL was designed with demonstration and educational purposes in mind.

FinRL is a good starting point for beginners to learn Deep Reinforcement Learning (DRL) algorithms like DQN. DDPG. PPO. A2C.

FinRL is a project that students can complete and add to their resume. They can also do the Show and Tell during the technical interview.

Who are the FinRL target users?

- FinRL (Proof-of-Concept) : Entry level for Beginners and Students with an educational and demonstrative purpose.

- FinRL 2.0.0 (Professional). is intermediate level for full stack developers and professionals. FinRL presents elegantRL, a lightweight DRL library that is scalable and optimized for finance.

- FinRL 4.0 (Production).: Advanced-level for investment bank and hedge fund. FinRL offers: a cloud native solution finRL-podracer .

What are the design principles of FinRL?

- Full-stack framework. To provide a complete DRL framework, with optimizations geared towards finance, such as market data, data preprocessing and DRL algorithms. This development pipeline can be used transparently by users.

- Customization. Maintain modularity and extensibility by including DRL algorithms of the latest generation and supporting design new algorithms. configurations can be used by DRL algorithms to create trading strategies.

- Hands-on tutoring. To provide tutorials, such as step by step Jupyter Notebooks, and user guide in order to assist users with walking through the pipeline and reproducing the use cases.

What is FinRL Framework?

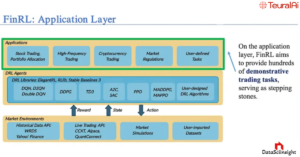

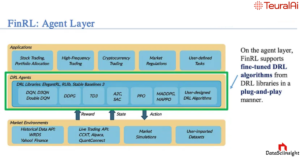

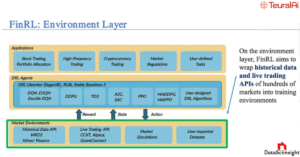

FinRL has three layers: application layer , agent layer , and environment layer .

- FinRL’s application layer aims to offer hundreds of demo trading tasks that users can use to build their own strategies.

- FinRL’s agent layer supports finely-tuned DRL algorithm from DRL libraries in a plug-and play manner following the unified workflow.

- FinRL’s environment layer aims to integrate historical trading data and live APIs for hundreds of markets, following the defact standards gym.

4 Comments